Genetics Basics

The breakage and rejoining may occur within a gene , leading to its inactivation. The motion of a gene can result in a rise or

et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia mollitia animi, id est

et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia mollitia animi, id est

molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id

et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga. Et harum quidem rerum facilis est et expedita distinctio et quas molestias excepturi sint

et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga.

The breakage and rejoining may occur within a gene , leading to its inactivation. The motion of a gene can result in a rise or

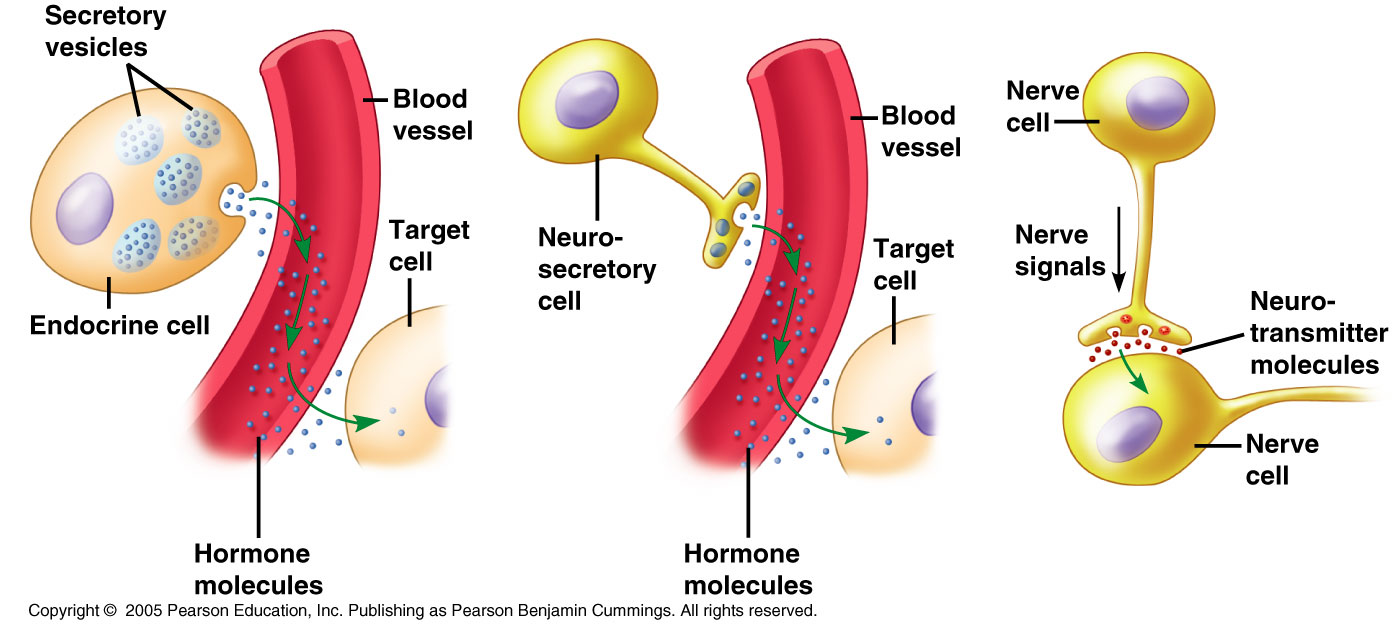

Its stimulation of either ovary or testicles leads to the discharge of an egg from the ovary in girls ortestosterone production in men. This take

Sample course titles required for this basic schooling part are listed under. Also, students who begin taking math in school preparatory ranges are capable of

June 9, 2021 • The Biden Administration is working to struggle climate change in a means that also address the nation’s financial and racial disparities.

It assesses the quality of varied technologies and packages, and advises on the relative significance of these packages. Specifically, extra time the variety of people

:max_bytes(150000):strip_icc()/two-hands-pour-contents-of-test-tube-into-laboratory-flask-155006089-5940123e5f9b58d58a12508a.jpg)

Select “concentration” to view the reactant and product concentrations plotted versus reactor quantity. The ultimate quantity corresponds to the quantity at the black dot on